Sponsored by RockWater

Manage a group of creator friends, roll some brand deals, exit for millions.

Sounds too good to be true?

Well…it is actually true!

Maybe an over-simplification, but companies without tech or owned IP are getting massive paydays. And if they do have owned IP or tech…oh boy…

Where does this leave you as a creator, creator rep, or potential buyer (please be my friend, potential buyers!)?

Also in this edition:

Dark Media vs. Social Media

OnlyFans Founder Launches OnlyFans Competitor

Moonvalley to the Moon with $53m in Funding

Roblox Sells Real Non-Blocky Stuff

Job ops from SMACKIN’, MomentIQ, and PRIMETIME Sports and Entertainment

…and a dank creator economy meme by yours truly!

Let’s get into it.

NEWS:

Buying Creators For Millions

For investor friends outside of the creator economy, a year of exploding M&A and investments in the industry left them scratching their heads.

“Aren’t they just buying creator relationships?”

“Isn’t that the same tech everyone has?”

“Influencer marketing tech is such a crowded market! Why pay so much to leap in the throng?”

Okay, so they make some good points. But it misses the big picture.

The whole entertainment industry, from integrated marketing to the studio system to IP development to live experiences, are driven in one shape or form by creators.

So big companies can either figure it out, or buy a team that are on the path to cracking the bigger codes.

And the latter is a heck of a lot faster.

I benefitted from the multi-channel network exits from the mid-2010’s that sprang from the same difficulty, but none of the buyers actually knew what they were buying.

Companies are far more strategic now, and even if they’re not buying or investing in perfect companies, here’s my best guess about why they made this call:

Publicis Buying BR Media Group. Publicis has a lot of brands in their portfolio with global infrastructure. BR Media Group absolutely owns Latin America, claiming relationships with over 500,000 creators that make up 80% of the market. And don’t sleep on the Latin American digital market: huge reach, plenty of high-quality creation and stars, strong shopping numbers, and loads of reach within the U.S.

Create Music Group Buying Monstercat for $50m Investment Commitment. CMG has big ambitions to be the new face of the music industry in the digital landscape, so they’re going hard at buying indie labels. Monstercat isn’t just a big indie EDM label, it has its hooks all over the internet. This will allow CMG to gain further digital reach, making them an even more appealing destination for the next generation of musicians and brands.

BratTV (ZATV) Buying Electric Monster. Electric Monster had some monster digital properties including React, Crypt TV, and People Vs. Food. BratTV has some monster digital properties including Chicken Girls. But I have a feeling it was Electric Monster’s deep knowledge of YouTube that made them the most appealing, since that institutional knowledge can keep the ball in the air for ZATV’s current properties while gaining some new ones.

Wonder Buying Tastemade for $90m. The company that owns BlueApron and Grubhub buying the biggest digital-first food company is no big surprise, especially at a steal (Tastemade has raised $35m to date). Both companies do loads of direct-response marketing, so the data and owned-and-operated channels alone are wildly valuable. But I also think the sheer amount Wonder’s companies spend on digital advertising means if Tastemade can make them 20% smarter, this was a steal.

ShopMy Raising $78m. I’ve probably gotten in the most arguments about whether or not this was a good idea. This is a crazy sum of money at a huge valuation for a platform whose total views over the last six months equal approximately one MrBeast video. I’m a believer for one reason: viewer intent. TikTok Shop gets a lot of frustrated viewers that have no intention of buying anything on the platform. Everyone visiting ShopMy is there to do one of two things: buy something or sell something. When you consider those 125m views in the last 6 months had high intent to buy, that makes a half of a billion dollar valuation seem reasonable.

Fox Buying Red Seat Media. This is the biggest no-brainer. Red Seat Media has huge reach in right-wing political podcasts. Fox’s portfolio, including Fox News, has tons of ‘red state’ brands. This is a classic 1 + 1 = 3 if you believe traditional media companies should be absolutely scrambling to build owned reach on digital platforms.

Fixated Raising $13m from Eldridge. (Transparency: I’m the Chief Business Officer at Fixated) Eldridge has strong Hollywood, publishing, and traditional sports media holdings valued at $72b. So why invest so heavily in a year old creator management org? I’m not allowed to be fully transparent, but I can say that expertise specifically in content as it pertains to creators has a lot of value for traditional brands. It’s not just about reach. It’s about deep knowledge around how to get reach again and with new properties.

Good Good Golf Raising $45m from Creator Sports Capital (part of Creator Capital). Creator capital is run by an OG in the creator space, Ben Grubbs, so he “gets it.” So why such a big number for a media company with a few million subscribers? Easy. The genre. The future of sports isn’t about leagues and teams. It’s about athletes and personalities. And Good Good Golf has relationships with huge stars like Steph Curry and a partnership with NBC Sports. If you believe the future of sports will be defined on internet platforms as I do, this was a strong way in.

Brave Bison Buying The Fifth for £7.6M. Brave Bison is huge in the European digital marketing world, and they’ve had a history for buying loads of boutique agencies. This strategy fits well, as many of these agencies have wonderful, loyal clients that are hard to extract, but large agencies have capabilities that allow for some major upsells. It’s a classic 1+1=3 as long as they don’t lose the boutique ‘heart’ by chasing the big tech ‘dollars.’

PodX Buying Lemonada for $30m. PodX acts more like a holding company than a podcast network, so the reason is obvious. But Lemonada is a steal at $30m. Why? Huge female demos for huge podcasts with huge celebrities. That’s a market segment that monetizes like crazy, and with many podcasts having an aggregate CPM over $100 per episode (when all ad reads are considered), assigning a 2x or 3x to that because of the demo value means skyrocketing revenue.

So creators, reps, platforms, and tech companies: how do you become the next big sale?

As you can see from these examples, the best way to exit is to become a shortcut for something valuable. Own a niche, grow very specific scale, or get a list of strong clients. You don’t have to abide by traditional VC rules. You just have to help big companies move fast in an industry that goes at neck-breaking speeds.

SPONSORED BY ROCKWATER

RockWater provides specialized M&A advisory for digital agency owners. TLDR: we find buyers to acquire your agency and negotiate the best deal possible for you.

We're trusted by leading creator economy agencies including: Long Haul Mgmt (sold to Wasserman), Bottle Rocket Mgmt (sold to Night), Oxford Road (sold to Insignia), Fixated ($10M capital raise), Bounty (sold to gen.video), The Creator Society (merger between 2 Social and Ensemble), and many more names you'd recognize.

If you're interested to learn more about what your agency is worth, reach out to [email protected] to set up an introductory call.

We also host premium exec networking events in NYC + LA. Fill out your details here to be included on the list.

GROW 1%:

Phil Ranta’s weekly social media growth newsletter with one actionable tip to grow.

This week’s ‘Grow 1%’ is titled Dark Social vs Social Media and discusses the importance of having a strategy within messaging-first platforms.

Here’s an excerpt, and you can read the entire edition in the link above:

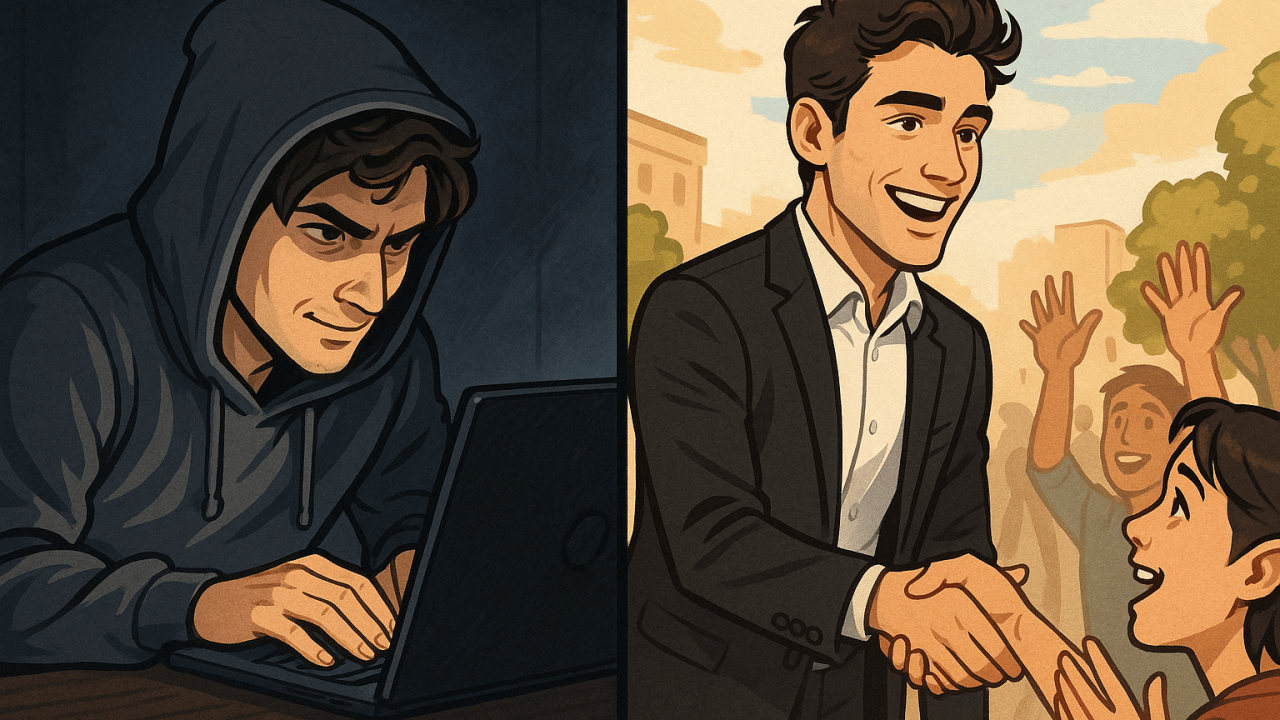

The name 'dark social' is terrible.

It makes normies think of the 'dark web,' full of conspiracy theories and hackers trading social security numbers.

But, alas, it's the term the market chose.

'Dark social' means sharing content through private channels like direct messages, e-mails, and private groups.

Think Messenger, Telegram, Discord, and the U.S. government's favorite app: Signal!

Every brand and creator has a social media strategy, but I'm amazed at how few have a 'dark social' strategy.

WHY WOULD YOU DO THAT?! Maybe because you don't know these stats:

63% of users prefer content and recommendations via dark social channels.

80% of social sharing of content happens via dark social channels.

Messaging apps have 20% more active users per month compared to social networks.

Dark social drives 3x more traffic than Facebook.

84% of content is shared through e-mails and messaging tools.

So you may be missing out. How do you fix this? Let's start with three simple strategies:

FAME & FORTUNE:

Subs.com* doesn’t feature delicious sandwiches, but does show OnlyFans’ founder Tim Stokely’s design chops with a more Instagram-style fan monetization platform with better discovery, a best-in-class referral program (see above), and far more brand-safe creators, though it’s still an 18+ platform. Definitely one to check out if you have an aesthetic client that just isn’t hitting on one of the other platforms!

Moonvalley, an AI video platform focused on licensed video training and HD AI video, raised $53m. We’ve seen a lot of AI video demos, including demos from Google and Meta, but I think Moonvalley has the most ‘cinema ready’ that I’ve seen. And clearly the investment community agrees.

Roblox now allows the selling non-blocky physical goods that will actually deliver to your door. To sell your wares you have to become an approved vendor, and it seems Roblox is leaning hard into the ‘this needs to be metaverse-native’ pitch, but considering they paid out $1b to world creators last year it feels like a good place to cement a strategy.

Linquia, the influencer marketing technology platform, released their Q1 2025 Influencer Marketing Report. And my favorite finding: brands aren’t scared of TikTok going away! But there are tons more gems in there, including promising metrics around an increase in AOR relationships.

“*” denotes an affiliate link

INDUSTRY HIRING:

SMACKIN’ needs an Affiliate & Influencer Manager to help show Gen Z that sunflower seeds aren’t just for 300 pound MLB managers.

MomentIQ is looking for a TikTok Shop - Brand Live Strategist. And if you get it, please stop showing me videos of phone tripods that fit in different weird places or I’m going to go broke.

PRIMETIME Sports and Entertainment wants a Brand Partnership Sales Director that loves soccer so much they actually believe ‘Welcome to Wrexham’ is a documentary.

MEME ZONE:

Those songs will never leave my brain…

Thank you for reading! If you enjoyed this edition, give it a share and if you get someone to sign up, I’ll send you my ‘10 Rep-Friendly Ways to Monetize Today!’ deck!

Until next time, protect yo rep.